Exactly what home loan rate will i rating with my credit history?

When you find yourself a credit score of 740 typically obtains a low prices, consumers with moderate borrowing from the bank can still pick aggressive options courtesy certain loan sizes.

Think of, your credit rating is the one bit of the brand new secret. Very why don’t we talk about all your options to make certain that you may be having the reduced speed simple for your credit score.

Exactly how credit ratings apply at mortgage pricing

It score is actually a numerical measure of the creditworthiness, considering affairs for example commission record, total personal debt, particular credit utilized, and you can length of credit history. Highest score fundamentally end in all the way down financial pricing, as the loan providers perceive you since a lowered-risk borrower.

Credit ratings have decided by credit reporting agencies particularly Equifax and you will Experian. Their total research assists lenders measure the danger of lending so you can your.

Credit sections as well as their impact on home loan pricing

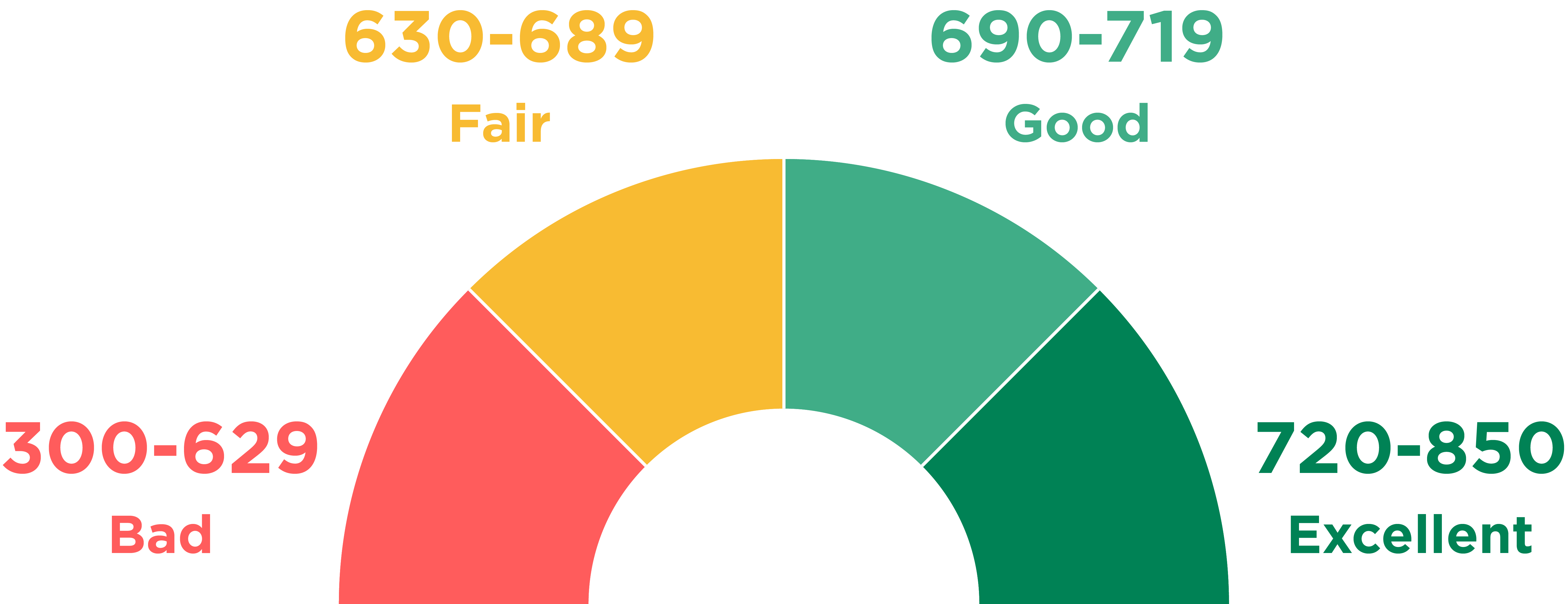

Mortgage brokers usually explore borrowing sections to choose interest rates, that are centered on Fico scores. FICO, quick to possess Fair Isaac Business, are a popular credit rating design. The following is a summary of normal credit levels and just how it apply at home loan pricing:

Home loan pricing by the credit history

Home loan interest levels may vary rather based on credit scores, resulting in good-sized differences in monthly home loan repayments and you will long-name interest costs for homeowners.

FICO, the biggest credit reporting providers from inside the American real estate, will bring a helpful online calculator that portrays just how much mortgage rates may differ centered on credit ratings. Case in point away from just how mediocre annual commission prices (:

Mortgage repayments by credit history

We’re going to have fun with that loan number, additionally the ple to demonstrate exactly how borrowing levels feeling mortgage payments and you may a lot of time-identity appeal will set you back. For many who examine the greatest and you can lower credit history levels, the brand new borrower having better borrowing from the bank conserves throughout the $445 30 days and you will $160,two hundred altogether focus across the lifetime of their mortgage loan.

*Percentage instances and you will ount regarding $405,eight hundred and loans Black you will a thirty-12 months fixed-price home loan. The rate of interest and you can payment may differ.

Plus home loan rates from the credit score, home values and home loan insurance can be considerably effect your own monthly mortgage money, especially in highest-pricing elements such as for example New york. Playing with home financing calculator can help you guess these will cost you and you can compare some other loan solutions.

Traditional loans wanted private financial insurance (PMI) getting off payments below 20% of the property rates, if you’re FHA finance keeps one another upfront and you may annual mortgage insurance costs (MIP).

The sort of loan you choose, such as for example a fixed-price or varying-rate financial (ARM), can also apply at their interest and you can enough time-identity will cost you. Consider carefully your financial predicament and you will specifications when deciding on financing to possess the majority of your home.

Home loan rates of the mortgage form of

Also credit history, financial rates together with differ by the mortgage types of. Listed below are some prominent financing designs in addition to their normal cost.

Traditional loan rates

Antique financing are the most typical form of financial and typically give competitive pricing getting borrowers which have a good credit score. Pricing are quite more than having bodies-recognized financing including FHA otherwise Va. Today’s financial rate to own conventional funds try % ( % APR).

FHA loan prices

Brand new Government Casing Management pledges FHA funds, this is why they often has straight down rates than simply antique funds. The current home loan rates for FHA financing was % ( % APR). These loans would be recommended for basic-big date home buyers with straight down credit scores or limited down payment finance.

Virtual assistant financing cost

Virtual assistant finance are available to qualified armed forces provider members, experts, and their spouses. They frequently feature lower costs than just antique funds and don’t wanted a down payment. The present mortgage speed to have a Virtual assistant mortgage is actually % ( % APR).